Money Investment and Saving Tricks: Your Path to Financial Peace

Hey there! I’m Priya, and I’ve been writing about personal finance for over two years now. One thing I’ve learned? ...

Read moreIs Real Estate a Good Investment? A Comprehensive Guide

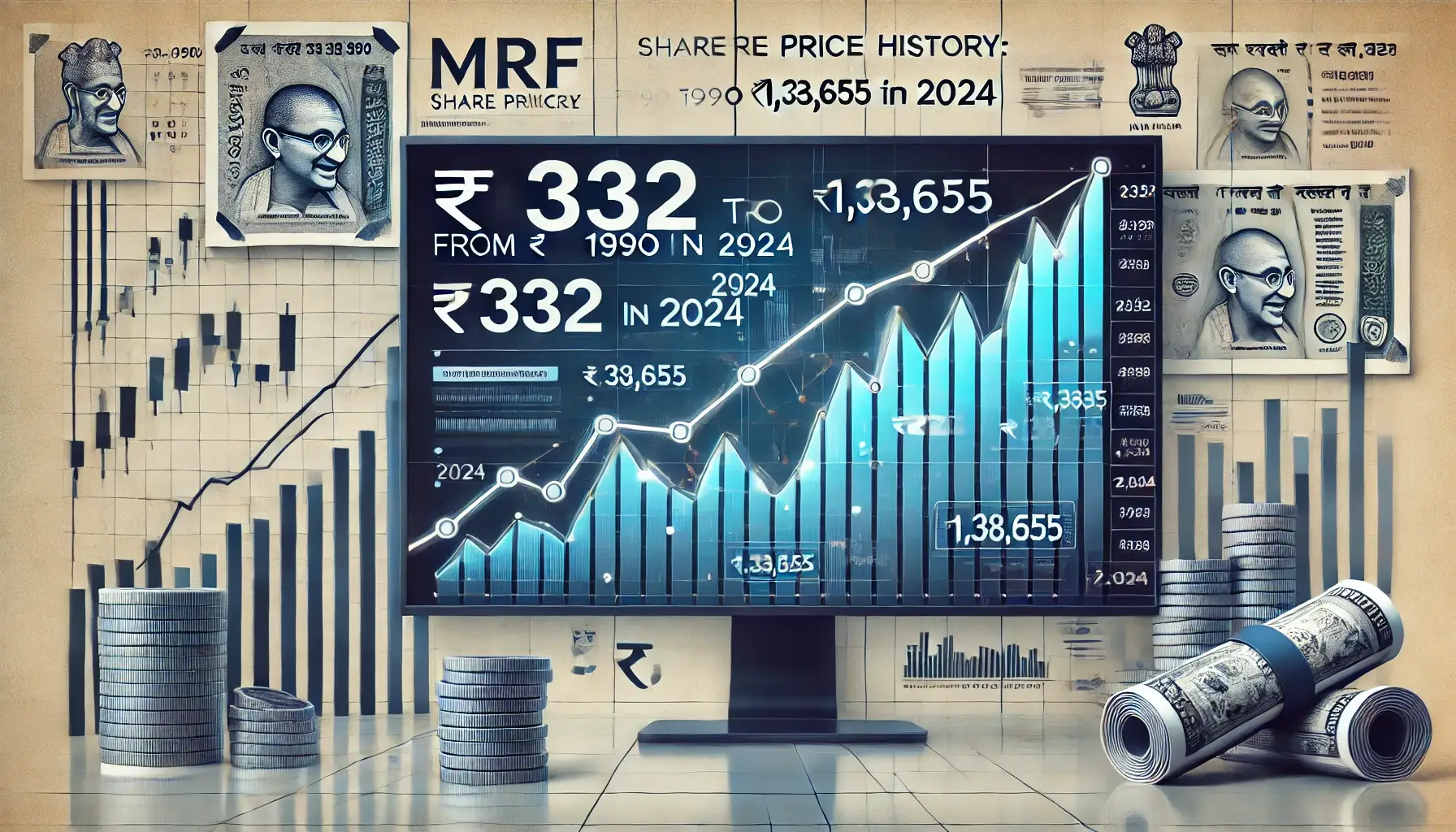

For the past couple of years, I’ve been knee-deep in the world of finance blogging. You name an investment avenue, ...

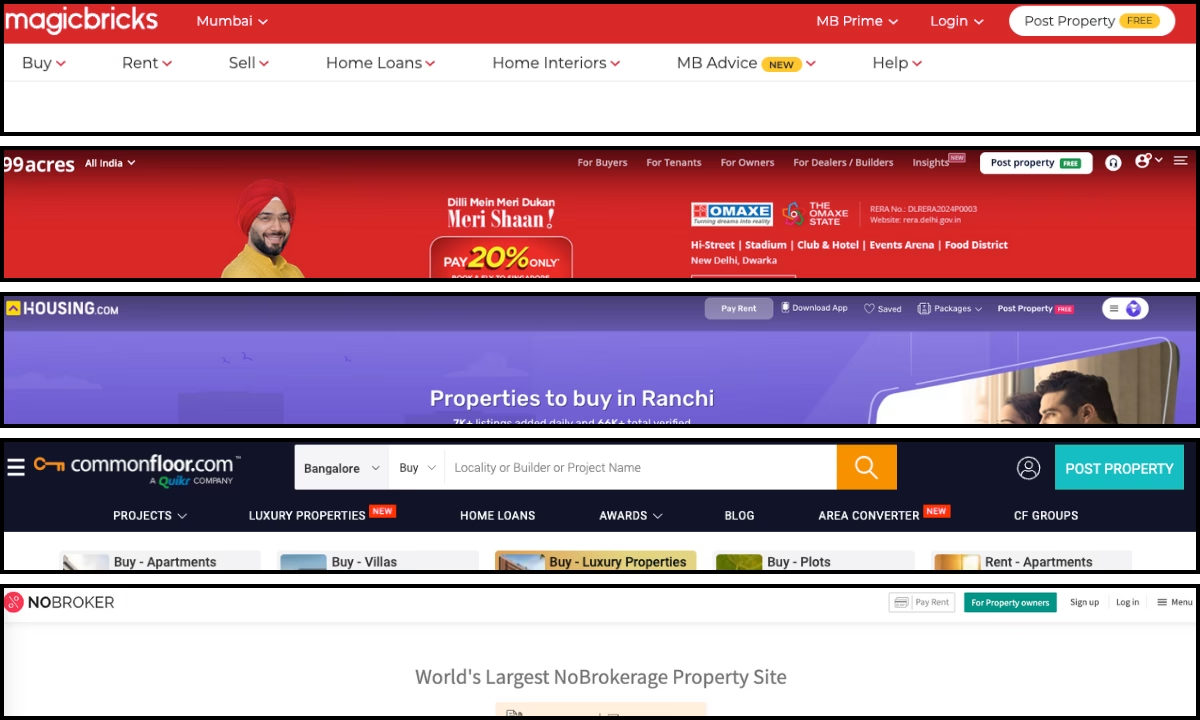

Read moreTop 5 Property Websites in India: Your Ultimate Guide for 2025

Imagine this: You’re a first-time homebuyer in Mumbai, scrolling through endless property listings. But instead of drowning in confusion, you ...

Read morePoonawalla Finance: A Deep Dive into India’s Rising NBFC Powerhouse

In the midst of India’s rapidly evolving financial landscape, Poonawalla Finance is emerging as a disruptive force in the NBFC ...

Read moreWheon.com Finance Tips for a Secure Financial Future

Imagine your finances as the foundation of a house. Without a solid base, even the most beautiful structure can crumble. ...

Read moreTop Paisa Kamane Wala Apps to Earn Real Money in 2025

Are you looking for easy ways to earn real money online? In today’s digital world, earning from your smartphone is ...

Read more