As we approach the close of 2024, India’s bike insurance market has seen significant growth, driven by an increase in two-wheeler sales and rising awareness about the importance of insurance. India is the world’s largest market for two-wheelers, with over 21 million units sold in 2023 alone. This rapid growth has been accompanied by an uptick in demand for comprehensive and reliable bike insurance coverage.

Moreover, road accidents involving two-wheelers continue to remain a concern. According to the Ministry of Road Transport and Highways, more than 37% of total road accidents in India involved two-wheelers in 2022, underscoring the need for robust insurance policies that provide financial protection.

In this evolving landscape, finding the best bike insurance provider can be overwhelming, especially with new players entering the market and existing companies enhancing their offerings. To help you navigate through the sea of options, we’ve compiled a list of the Top 10 Bike Insurance Companies in India for 2024.

This in-depth guide compares the best bike insurance companies based on key factors like claim settlement ratio, premium costs, customer satisfaction, and additional features like zero-depreciation cover and roadside assistance. Whether you’re insuring a new bike or renewing your existing policy, this article will help you make an informed decision to safeguard your ride without breaking the bank.

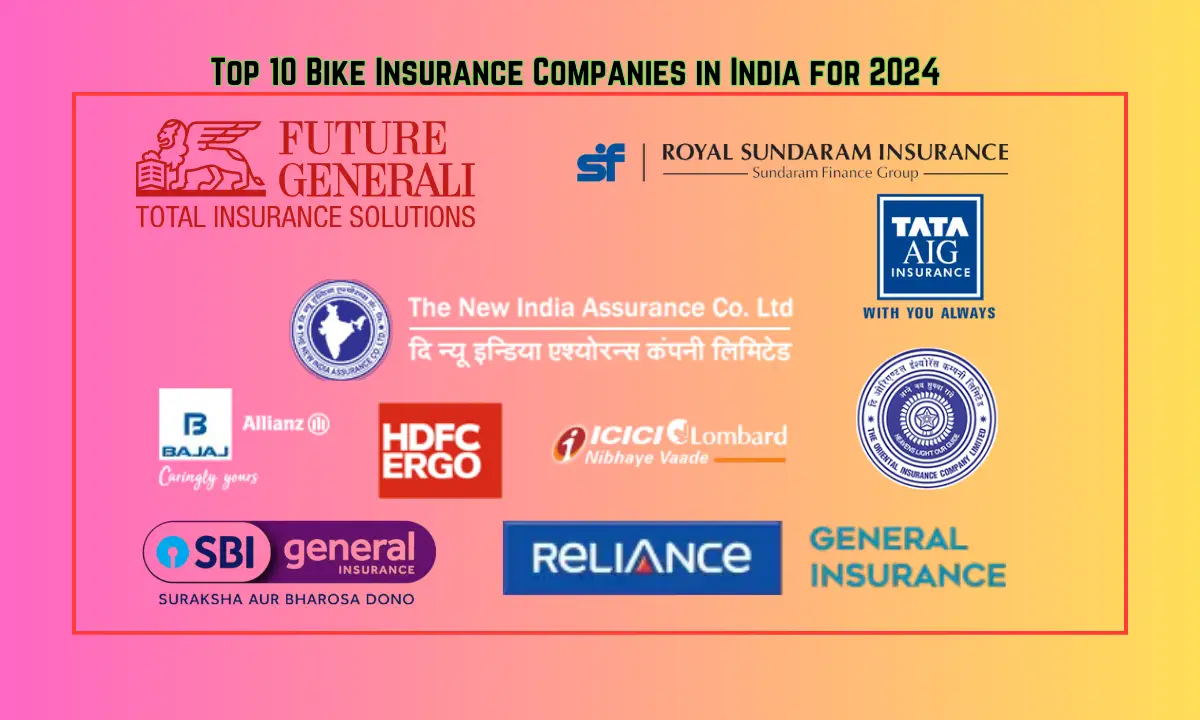

Top 10 Bike Insurance Companies in India for 2024

Discover the top bike insurance providers in India offering the best claim settlement ratios, premium rates, and customer service for 2024.

Best Bike Insurance Companies Based on Claim Settlement Ratio

Claim settlement ratio is crucial when selecting an insurance provider. ICICI Lombard, Bajaj Allianz, and HDFC ERGO lead the market with high claim settlement ratios above 95%.

Affordable Bike Insurance Plans in India 2024

Looking for affordable yet comprehensive bike insurance? Companies like SBI General Insurance and Royal Sundaram offer competitive premiums without compromising on coverage.

Comprehensive Bike Insurance vs. Third-Party Insurance

Understand the key differences between comprehensive and third-party insurance plans. Comprehensive policies cover damages to your bike, while third-party insurance only covers third-party liabilities.

Best Bike Insurance with Additional Features

Want more than basic coverage? Tata AIG and HDFC ERGO provide attractive add-ons like zero depreciation cover, engine protection, and roadside assistance.

How to Choose the Best Bike Insurance in India

When choosing a bike insurance plan, focus on claim settlement ratios, premium costs, add-on options, and customer service. Companies like Bajaj Allianz and ICICI Lombard balance these factors well.

Also read Skill India: Key Government Initiatives Shaping the Future Workforce.

Why Bike Insurance Is Essential in India

In India, bike insurance isn’t just a luxury—it’s a necessity. According to the Motor Vehicles Act, 1988, every two-wheeler owner must have at least third-party insurance coverage to legally ride on Indian roads. Beyond legality, bike insurance offers several key benefits that every bike owner should consider.

1. Legal Compliance:

Bike insurance is required by law in India. Failing to have at least a third-party liability cover can result in hefty fines or, worse, imprisonment. This legal mandate ensures that any damage caused to a third party during an accident is financially covered.

2. Financial Protection:

Accidents, natural disasters, and theft are unpredictable events that can leave you with a significant financial burden. A comprehensive bike insurance policy not only covers the cost of repairs to your bike but also ensures you aren’t stuck with huge bills in case of total damage or theft. Considering the increasing number of bike thefts in major cities like Mumbai, Delhi, and Bangalore, insurance provides much-needed financial relief.

3. Third-Party Liability:

This is the minimum coverage required under Indian law and protects you from any financial liabilities arising from injuries or damages caused to a third party. For instance, if your bike is involved in an accident that injures another person or damages their property, the insurance will cover these expenses.

4. Personal Accident Cover:

Many bike insurance policies include personal accident cover for the rider, providing compensation in case of permanent disability or death due to a road accident. This ensures financial security for your family in unfortunate circumstances.

5. Importance of Choosing the Right Insurer:

With numerous companies offering various bike insurance plans, choosing the right insurer can make a significant difference in terms of service quality, claim settlement experience, and overall coverage. The best bike insurance companies not only offer competitive premium rates but also ensure smooth claim settlements, additional perks, and robust customer support.

By selecting a reliable insurer with a good track record in claim settlement, you can avoid the stress of delayed claims, unclear policy terms, or inadequate coverage when you need it the most.

Key Factors to Consider When Choosing Bike Insurance

With numerous bike insurance providers in the market, selecting the right one can seem daunting. However, focusing on a few key factors can simplify the decision-making process and ensure that you find a policy that fits your needs and budget. Let’s take a look at the most critical aspects you should consider when choosing bike insurance:

Claim Settlement Ratio (CSR)

The claim settlement ratio (CSR) is one of the most important metrics to evaluate when choosing a bike insurance company. It refers to the percentage of claims that an insurer successfully settles compared to the total number of claims received. A higher CSR indicates a more reliable insurer that is more likely to honor claims without unnecessary delays or rejections.

- Why It Matters: If an insurance company has a high CSR, it means they process and settle most claims efficiently, offering you peace of mind that your claim won’t be stuck in a lengthy process.

- Top Providers in CSR: Companies like ICICI Lombard and Bajaj Allianz boast CSRs of over 95%, making them industry leaders in claim settlements.

Premium Costs

While insurance premiums are essential, it’s not just about finding the lowest price. Premium costs are determined by several factors, including the bike’s model, engine capacity, location, the rider’s age, and driving history. You need to weigh the cost of the premium against the coverage offered to ensure that you’re getting the best value for your money.

- Factors Affecting Premiums:

- Bike Model: Higher engine capacity bikes (e.g., 200cc or above) attract higher premiums.

- Location: Riders in metro cities like Delhi or Mumbai generally face higher premiums due to higher risks of accidents and theft.

- Add-ons: Features like zero depreciation, roadside assistance, and engine protection increase the premium but offer enhanced coverage.

- Best for Affordable Premiums: Insurers like SBI General Insurance and Reliance General Insurance offer affordable premiums without compromising on essential coverage. Premiums for entry-level bikes (100cc to 125cc) start as low as ₹700 to ₹1,200 annually for basic third-party insurance.

Customer Satisfaction

Customer reviews and ratings offer valuable insights into how an insurance company treats its customers post-sale. This is especially important when it comes to customer service, claim handling, and overall experience. Insurers that provide seamless customer support—especially during the claims process—are often preferred by policyholders.

- How to Gauge Customer Satisfaction:

- App Reviews: Many insurers have dedicated apps that allow users to buy, renew, and claim insurance. Looking at app ratings and reviews can give you an idea of the user experience.

- Social Media Feedback: Social media platforms are another useful resource where customers often voice their concerns or praise for a company’s service.

- Top Performers in Customer Satisfaction: Companies like Tata AIG and HDFC ERGO frequently receive praise for their fast and hassle-free claims process and user-friendly mobile apps, both rated over 4 stars in app stores.

Additional Features and Add-ons

Beyond basic coverage, many bike insurance companies offer add-on features that can enhance your protection. These add-ons come at an extra cost but can prove beneficial depending on your specific needs.

- Popular Add-ons:

- Zero Depreciation Cover: Ensures that the insurer covers the full cost of bike parts without factoring in depreciation, making it especially useful for new bikes.

- Roadside Assistance: Provides immediate help if your bike breaks down or if you’re stranded due to mechanical issues or accidents.

- Engine Protection Cover: Covers the cost of repairing or replacing the bike’s engine, which is typically excluded from standard policies.

- Personal Accident Cover for Pillion Riders: Offers protection for a pillion rider in case of accidents, which is especially useful for those frequently traveling with passengers.

- Companies with Best Add-ons: Bajaj Allianz and HDFC ERGO offer a wide range of add-ons like zero depreciation and engine protection, making them popular choices for riders seeking comprehensive coverage.

Also Read Top 5 Best Weight Loss and Fitness Apps in India (2024).

The Top 10 Bike Insurance Companies in India for 2024

Choosing the best bike insurance company requires a thorough understanding of each provider’s reputation, services, and customer satisfaction. Below is a detailed comparison of the Top 10 Bike Insurance Companies in India for 2024, providing essential insights into their claim settlement ratios, premium costs, and additional features.

1. ICICI Lombard General Insurance

ICICI Lombard is one of India’s leading general insurance companies, known for its wide network and comprehensive range of insurance products. It has a strong presence across the country, with numerous branches and a highly rated mobile app, making it a popular choice for bike insurance.

- Claim Settlement Ratio: 96%

- Premium Costs: Starting at ₹1,200 for third-party insurance for a 125cc bike.

- Customer Satisfaction: Rated 4.2 stars on their mobile app, with positive feedback on quick claim processing and customer support.

- Additional Features: Offers a wide range of add-ons including zero depreciation, roadside assistance, and engine protection.

- Pros: ICICI Lombard is known for its extensive network of cashless garages and a user-friendly claims process, making it a top choice for many riders.

- Cons: Slightly higher premium costs compared to some competitors for comprehensive policies.

2. Bajaj Allianz General Insurance

Bajaj Allianz is a joint venture between Bajaj Finserv Limited and Allianz SE, one of the world’s largest insurance companies. Known for its innovative insurance solutions, Bajaj Allianz has a strong reputation for its customer-centric approach and efficient claim settlements.

- Claim Settlement Ratio: 95%

- Premium Costs: ₹1,100 to ₹1,500 annually for basic third-party insurance (depending on bike model and location).

- Customer Satisfaction: Rated 4.3 stars for its efficient claims process and customer-centric services.

- Additional Features: Add-ons such as zero depreciation, personal accident cover for pillion riders, and long-term coverage options.

- Pros: Known for its fast and smooth claims processing, Bajaj Allianz is a trusted name with excellent add-on options for riders.

- Cons: Premiums for older bikes can be slightly higher.

3. HDFC ERGO General Insurance

HDFC ERGO is a prominent name in the Indian insurance industry, offering a diverse range of general insurance products, including bike insurance. It’s known for its digital-first approach and customer-friendly services, making it easy for policyholders to manage policies and claims online.

- Claim Settlement Ratio: 94%

- Premium Costs: Starting at ₹1,000 for basic third-party insurance.

- Customer Satisfaction: Rated 4.1 stars for its app-based services and user-friendly policy management.

- Additional Features: Offers comprehensive add-ons like consumables cover, emergency assistance, and zero depreciation.

- Pros: HDFC ERGO’s competitive pricing and range of add-ons make it a popular choice, especially for riders seeking full coverage at reasonable rates.

- Cons: Some customers have reported delays in the claim settlement process.

4. New India Assurance

New India Assurance is a government-owned insurance company, established in 1919, making it one of the oldest and most trusted names in the Indian insurance market. The company offers a range of policies, including bike insurance, and is known for its financial stability and wide reach.

- Claim Settlement Ratio: 93%

- Premium Costs: Starting at ₹950 for basic third-party cover.

- Customer Satisfaction: Rated 4.0 stars, with customers appreciating their government-backed assurance.

- Additional Features: Comprehensive coverage with affordable premiums, offering third-party liability and PA cover.

- Pros: Government-backed reliability and affordable premiums make New India Assurance a strong contender for budget-conscious riders.

- Cons: Customer service is not as fast as some private players, with occasional delays in claims processing.

5. Oriental Insurance

Oriental Insurance is another government-owned insurer, founded in 1947, with a solid reputation in providing various general insurance products, including bike insurance. It has a wide network across India, particularly popular in rural and semi-urban areas.

- Claim Settlement Ratio: 92%

- Premium Costs: ₹1,100 for third-party cover for a 150cc bike.

- Customer Satisfaction: Mixed reviews, with an overall 3.8-star rating, with some complaints about slow customer service.

- Additional Features: Customizable plans, third-party liability, and add-ons like zero depreciation.

- Pros: Known for its affordable premiums and customizable coverage options.

- Cons: Customer service and claims processing can be slower compared to other top insurers.

6. Reliance General Insurance

Reliance General Insurance, part of the Reliance Group, is a fast-growing player in the general insurance market. It offers a range of digital-first services, including bike insurance, making it popular among tech-savvy users who prefer managing their insurance online.

- Claim Settlement Ratio: 91%

- Premium Costs: Starting at ₹1,050 for basic third-party insurance.

- Customer Satisfaction: Rated 4.1 stars, praised for quick online services and a smooth claims process.

- Additional Features: Roadside assistance, zero depreciation, and engine protection are some of the key add-ons.

- Pros: Easy-to-navigate digital platform and competitive premiums make Reliance a preferred choice for tech-savvy users.

- Cons: Slightly higher premiums for comprehensive policies, especially for newer bikes.

7. TATA AIG General Insurance

Yes TATA AIG is a joint venture between the Tata Group and American International Group (AIG), combining the strength of two major global brands. TATA AIG is highly regarded for its strong customer service and wide range of customizable insurance products, including bike insurance.

- Claim Settlement Ratio: 96%

- Premium Costs: ₹1,200 to ₹1,500 depending on the bike’s make and model.

- Customer Satisfaction: Rated 4.3 stars, with excellent reviews for fast claim settlements and a user-friendly app.

- Additional Features: Offers unique add-ons like consumables cover, engine protect cover, and zero depreciation.

- Pros: TATA AIG is highly rated for its fast claims service and wide range of add-ons, making it ideal for riders seeking comprehensive protection.

- Cons: Premiums can be slightly higher for high-end bikes.

8. Royal Sundaram General Insurance

Royal Sundaram was the first private insurer in India to be licensed after the sector was opened up. It offers a wide range of insurance products, including bike insurance, and has built a strong reputation for providing affordable coverage with a customer-first approach.

- Claim Settlement Ratio: 90%

- Premium Costs: Starting at ₹900 for third-party coverage.

- Customer Satisfaction: Rated 4.0 stars, with positive feedback on quick and simple policy renewals.

- Additional Features: Offers a comprehensive range of add-ons including cashless garage network and roadside assistance.

- Pros: Known for its affordable premiums and wide network of garages for easy claims.

- Cons: The range of add-ons is limited compared to other competitors.

9. SBI General Insurance

SBI General Insurance, a joint venture between the State Bank of India (SBI) and Insurance Australia Group (IAG), is one of the fastest-growing insurance companies in India. It is widely trusted due to its association with SBI, one of India’s largest and most reputable banks.

- Claim Settlement Ratio: 89%

- Premium Costs: Starting at ₹950 for third-party insurance.

- Customer Satisfaction: Rated 4.1 stars, with customers praising the company’s 24/7 customer support and ease of policy management.

- Additional Features: Roadside assistance, engine protection, and personal accident cover are popular add-ons.

- Pros: Affordable premiums and the trust associated with SBI’s brand make it a reliable option for bike owners.

- Cons: Claim processing times can be slower compared to private players.

10. Future Generali India Insurance

Future Generali is a joint venture between the Future Group and Generali, a global insurance giant. The company offers a range of general insurance products, including bike insurance, and is known for its affordability and extensive online services.

- Claim Settlement Ratio: 88%

- Premium Costs: Starting at ₹1,100 for third-party cover.

- Customer Satisfaction: Mixed reviews, with a 3.9-star rating, with some customers citing delays in the claims process.

- Additional Features: Zero depreciation, roadside assistance, and engine protection available as add-ons.

- Pros: Offers affordable comprehensive policies with easy online renewals.

- Cons: Customer service and claims settlement can be slower compared to top insurers in the list.

Detailed Comparison of the Top 10 Bike Insurance Companies in India 2024

When choosing a bike insurance policy, it’s essential to compare the key aspects that matter most to you, such as claim settlement ratio, premium costs, and the range of additional features offered by the insurer. Below is a comparison table that highlights these important metrics for the top 10 bike insurance companies in India for 2024.

| Insurance Company | Claim Settlement Ratio | Starting Premium (₹) | Key Add-ons | Customer Satisfaction Rating |

|---|---|---|---|---|

| ICICI Lombard | 96% | ₹1,200 | Zero Depreciation, Engine Protect | 4.2/5 |

| Bajaj Allianz | 95% | ₹1,100 | Zero Depreciation, Personal Accident | 4.3/5 |

| HDFC ERGO | 94% | ₹1,000 | Consumables Cover, Roadside Assistance | 4.1/5 |

| New India Assurance | 93% | ₹950 | Personal Accident Cover, Third-party | 4.0/5 |

| Oriental Insurance | 92% | ₹1,100 | Zero Depreciation, Customizable Plans | 3.8/5 |

| Reliance General Insurance | 91% | ₹1,050 | Roadside Assistance, Zero Depreciation | 4.1/5 |

| TATA AIG | 96% | ₹1,200 | Consumables, Zero Depreciation | 4.3/5 |

| Royal Sundaram | 90% | ₹900 | Cashless Garages, Roadside Assistance | 4.0/5 |

| SBI General Insurance | 89% | ₹950 | Engine Protection, Personal Accident | 4.1/5 |

| Future Generali | 88% | ₹1,100 | Roadside Assistance, Zero Depreciation | 3.9/5 |

How to Use This Comparison Table

When choosing the best bike insurance policy, consider the following factors:

- Claim Settlement Ratio: A higher ratio ensures quicker and more successful claim settlements. ICICI Lombard and TATA AIG, with 96% CSR, lead in this area.

- Premium Costs: Depending on your budget and coverage needs, look at premium costs. Royal Sundaram and New India Assurance offer some of the most affordable premiums, starting from ₹900 to ₹950.

- Key Add-ons: Add-ons like zero depreciation, roadside assistance, and engine protection can make a significant difference, especially for riders with newer bikes or those seeking enhanced protection.

- Customer Satisfaction: A company’s customer satisfaction rating reflects its service quality. Bajaj Allianz and TATA AIG stand out with ratings above 4.3/5, praised for their fast and hassle-free claims process.

By evaluating these metrics, you can choose a policy that meets your needs for coverage, affordability, and service quality.

How to Choose the Best Bike Insurance for You in 2024

Selecting the right bike insurance policy can seem overwhelming, especially with so many options available. However, by focusing on a few key factors, you can easily narrow down your choices to find the policy that best suits your needs. Here are some practical tips to guide you through the decision-making process:

Identify Your Coverage Needs

Before you start comparing insurance providers, it’s essential to understand what kind of coverage you need. Different riders have different requirements based on factors like bike usage, age, and location. Here’s a breakdown to help you decide:

- Comprehensive Insurance: This is the most popular choice for bike owners as it provides coverage against both third-party liabilities and damages to your bike. If you have a new bike or a high-value model, this policy is essential to cover accidents, theft, natural calamities, or vandalism.

- Third-Party Insurance: This is the mandatory minimum insurance required by Indian law. It only covers damage or injury caused to third parties. This option is cheaper but does not protect your own bike in case of an accident or theft. Opt for this if you own an older or lower-value bike and want to keep costs down.

- Add-ons: Depending on your lifestyle and needs, you may want to consider add-ons like zero depreciation (especially for new bikes), engine protection, or personal accident cover for the pillion rider.

Consider the Claim Settlement Ratio

As we’ve seen, the claim settlement ratio (CSR) is a crucial metric that indicates how efficient an insurer is in processing and approving claims. Opt for companies with higher CSRs, such as ICICI Lombard or TATA AIG, which have CSRs of 96%. A high CSR ensures that your claims are likely to be settled smoothly and promptly in case of an accident or loss.

If you’re someone who prioritizes hassle-free claim settlements, choosing an insurer with a proven track record in this area should be a top priority.

Evaluate Premium Costs vs. Coverage

While it might be tempting to go for the cheapest insurance premium, it’s vital to strike the right balance between cost and coverage. A low premium might not offer the comprehensive protection you need, and you could end up paying more out of pocket in case of an accident.

- Affordable Premiums: Companies like SBI General Insurance and Royal Sundaram are known for their budget-friendly premium rates, which can be as low as ₹900 for basic third-party insurance. However, if you are riding in a high-risk area or using a high-value bike, it may be worth paying extra for comprehensive coverage from companies like Bajaj Allianz or HDFC ERGO.

- Long-Term Policies: Consider opting for long-term bike insurance policies (up to 3 years) to lock in your premium rates and avoid yearly renewals. Companies like Bajaj Allianz and TATA AIG offer long-term policy options that save you both time and money.

Look for Customer Reviews and Support

Customer satisfaction plays a crucial role in determining how smoothly your policy will function. Positive reviews, especially regarding claim processing, customer service, and digital platforms, are important indicators of a good insurer.

- Top Performers in Customer Support: Companies like Bajaj Allianz and HDFC ERGO are praised for their efficient customer service and user-friendly apps. Many customers find the process of buying and renewing policies online seamless and stress-free.

- 24/7 Support: Look for insurers that provide 24/7 customer support and have a large network of cashless garages to ensure that you’re covered no matter where you are. SBI General Insurance and Reliance General Insurance stand out for their extensive support networks.

Assess Additional Features and Add-ons

Add-ons can make a significant difference in the protection your bike gets. Here are some of the most popular add-ons you should consider:

- Zero Depreciation Cover: Especially useful for new or high-end bikes, zero depreciation ensures that you get the full cost of damaged parts without considering depreciation. This is available with insurers like ICICI Lombard, Bajaj Allianz, and HDFC ERGO.

- Engine Protection: This add-on covers damages to your bike’s engine, which is usually excluded from basic policies. If you live in a flood-prone area or frequently ride through water-logged roads, engine protection from companies like Reliance General or SBI General Insurance could be valuable.

- Personal Accident Cover: Ensure you have personal accident cover for yourself and consider adding pillion rider cover if you frequently carry passengers. Bajaj Allianz and HDFC ERGO offer extensive personal accident coverage options.

Personalized Recommendations Based on Your Needs

For Budget-Conscious Riders: If you’re looking for the most affordable premiums without compromising on basic coverage, Royal Sundaram and SBI General Insurance are great options. Their third-party insurance policies are budget-friendly and perfect for older or low-value bikes.

- For New Bike Owners: If you’ve just bought a new bike, you should prioritize comprehensive coverage with zero depreciation. ICICI Lombard, Bajaj Allianz, and TATA AIG are excellent choices for full protection, including add-ons like engine protection and roadside assistance.

- For Riders Who Prioritize Fast Claim Settlement: If quick and hassle-free claim settlement is your top priority, Bajaj Allianz, ICICI Lombard, and HDFC ERGO are your best bets. Their high claim settlement ratios and fast service make them industry leaders in this area.

- For Long-Term Policy Seekers: If you prefer locking in your premium for a few years, consider insurers like Bajaj Allianz and HDFC ERGO, which offer long-term policies that save you from yearly renewals and potential premium hikes.

Final Thoughts

Choosing the right bike insurance policy is a critical decision for every bike owner in India. With the growing number of two-wheelers on the road, coupled with the high risk of accidents and theft, having reliable coverage is essential for financial protection and peace of mind.

Based on your individual needs—whether it’s affordability, comprehensive coverage, or fast claim settlement—you can pick the right insurer from our list of the Top 10 Bike Insurance Companies in India for 2024.

- ICICI Lombard and Bajaj Allianz stand out with their high claim settlement ratios and customer satisfaction.

- SBI General Insurance and Royal Sundaram are excellent options for budget-conscious riders, offering competitive premiums without compromising on essential coverage.

- If you’re seeking additional features like zero depreciation or engine protection, HDFC ERGO and TATA AIG offer comprehensive policies with valuable add-ons.

By evaluating factors such as claim settlement ratio, premium costs, customer reviews, and additional features, you can confidently choose a bike insurance policy that fits your lifestyle, riding habits, and budget. Remember, the best insurance policy isn’t just the one that’s cheapest but the one that gives you the most peace of mind when you hit the road.

Note:

The premium costs mentioned in this article are approximate starting prices and are subject to change based on factors like the bike model, location, driving history, and ongoing promotions by the insurance providers. Please check with the respective insurance companies for the most up-to-date pricing.

Join Telegram ChannelFAQs

A claim settlement ratio (CSR) above 90% is generally considered good. The higher the ratio, the more likely it is that your claims will be processed and settled without issues. Companies like ICICI Lombard and TATA AIG have a CSR of 96%, making them highly reliable.

Several factors influence your bike insurance premium, including:

Bike model and engine capacity: Higher engine capacity bikes (e.g., 200cc or more) attract higher premiums.

Location: Riding in metro cities like Mumbai, Delhi, or Bangalore can increase your premium due to higher risks.

Rider’s age and driving history: Younger riders or those with a history of accidents may face higher premiums.

Add-ons: Choosing additional coverage like zero depreciation or engine protection increases the premium.

While third-party insurance is the legal minimum required in India, it only covers damages or injuries caused to others. It doesn’t cover damages to your bike or offer personal accident protection. For more comprehensive protection, consider comprehensive insurance that covers both third-party liabilities and damages to your bike.

Zero depreciation cover ensures that your insurer pays the full cost of replacing bike parts in case of damage, without considering depreciation. This is especially useful for new bikes or expensive models, as you will receive a higher claim amount for repairs. It’s a recommended add-on for new bike owners.

Yes, you can switch your bike insurance company when renewing your policy. Make sure to compare the claim settlement ratio, premium costs, and additional features before making the switch. Also, ensure that you transfer your No-Claim Bonus (NCB) to the new insurer if you haven’t made any claims during the policy period.

To file a bike insurance claim:

Notify your insurer immediately after the incident (accident, theft, or damage).

Submit the required documents, including the FIR (in case of theft), bike registration papers, and your insurance policy.

An insurance surveyor will assess the damage.

Once the claim is approved, you can either get cashless repair services at a network garage or reimburse the expenses afterward.